The Good, the Bad, and the Haggis

Forwarded this email by a friend? Subscribe here.

All eyes are trained on Glasgow this week, where the most powerful decision-makers in the world have gathered to talk climate. The 26th UN Climate Change Conference, or COP26, is being closely followed for new climate commitments and deals as the urgency to stop the planet’s heating grows. And there has been some real progress. So far, we’ve seen:

Global pledges have been made by around 100 countries to end and reverse deforestation by 2030 and cut methane emissions by 30% of 2020 levels by 2030.

- Why this matters: This represents real consensus around key elements that are needed to combat climate change, and could set the stage for further progress over the coming days.

Over 450 financial firms, representing an eye-popping $130 trillion in assets, joined former Bank of England Governor Mark Carney's Glasgow Financial Alliance for Net Zero to set net-zero targets.

- Why this matters: This is noteworthy because it shows a new level of private sector involvement in the conference, but critics say this move doesn’t reduce financing in fossil fuels nor absolute emissions, and that companies can’t be trusted to self-regulate.

A number of nations sharply criticized richer countries that have yet to fully fund their commitments towards a $100 billion target to help reduce emissions, and there are no concrete plans to fill this gap.

- Why this matters: Many of the emerging nations leading the calls for support are seeing direct impact from climate change; their calls raise many questions about the depth of the commitments behind the proclamations of consensus.

COP26 continues through Nov 12, so we'll bring you the biggest takeaways in next week's edition. In the meantime, enjoy a peek at what’s literally on the menu at COP26, including its carbon footprint. Can’t help noticing that haggis, the notorious Scottish national dish, comes in at 3.4 Kg CO2e — double an average meal in the UK.

3 tips to kick off your sustainable investing journey

Starting something new is often a little nerve-wracking. But entry points for sustainable investing are more accessible than you might think. As our CEO Jean Case recently wrote in MarketWatch, it’s possible for anyone to help make the world a better place while also generating some of those sweet, sweet returns.

- Decide what matters most to you. Investment decisions are highly personal, whether you’re a seasoned portfolio maven or just getting started. Your risk tolerance and desired rate of financial return—for instance, whether you want to build a 401K for retirement, or see if the markets can double your annual bonus — will shape your strategy, as will the issues you care about (and what your standards are for considering an investment “sustainable”). Start by identifying your priorities, and then get a lay of the land with a list like JUST Capital’s corporate rankings, which include performance on stock price as well as issues like environmental sustainability and workplace diversity.

- Pick a trading platform where you can focus your efforts. If you are brand-new to investing, it may be easiest to start with a retail investing app like Robinhood, Acorns, or Betterment, or the offerings from more traditional platforms like Fidelity, which can group ETFs, mutual funds, or individual shares that align with certain values. These platforms require a relatively low minimum investment (generally under $100), making diversification easier, and offer step-by-step guidance for newbies. (However, always read the fine print about management fees.) If you are already investing, decide how much capital in your existing portfolio(s) you’re willing to use to start your journey —again, this will be shaped by your personal goals. Talking to a financial advisor that specializes in impact or ESG investing may be a good idea, especially if you’re looking to move a large chunk of change.

- Follow the data. There are many free online tools for assessing the impact and return potential of a mutual fund, ETF, public company, or startup — including, in some cases, how they stack up relative to their peers. Current investors can open up their prospectus and hit the Google machine to see how the investments in their portfolio already line up; newcomers can identify the leaders on different issues and start making investments. This works in reverse, too — you may decide that you not only want to invest in what you believe in, but also divest from what you don’t. A number of good resources can be found in these MarketWatch and Forbes articles.

DeFi-ng gravity

Beyond the headlines, memes, and dramatic price movements, cryptocurrencies and blockchain are quietly revolutionizing one of the biggest institutions in the world – banking.

The cryptocurrency space is quickly moving towards the mainstream. About 40% of investors between 18 and 40 own virtual money, the first Bitcoin-based ETF launched this month, mainstream retailers like Walmart have Bitcoin kiosks, and we’re finding many new uses for the underlying blockchain technology, like hosting the NFT marketplace. There’s also the weird stuff, like a new craze for small Tungsten cubes, reality stars promoting potential scams on social media, and not one but TWO dog-themed digital coins making billionaires out of a lucky few.

“Decentralized” is a key word here — it implies doing away with central authorities and middlemen. The aim of supporters is to build a borderless financial ecosystem that is faster and more transparent, fair, secure, and accessible than what we have now.

The financial services you regularly access, whether it’s payments, savings, investments, or loans, are all linked to traditional banks and central banks, like the US Federal Reserve. The social need for change is clear – 7.1 million households in America did not have at least one bank or credit union account in 2019.

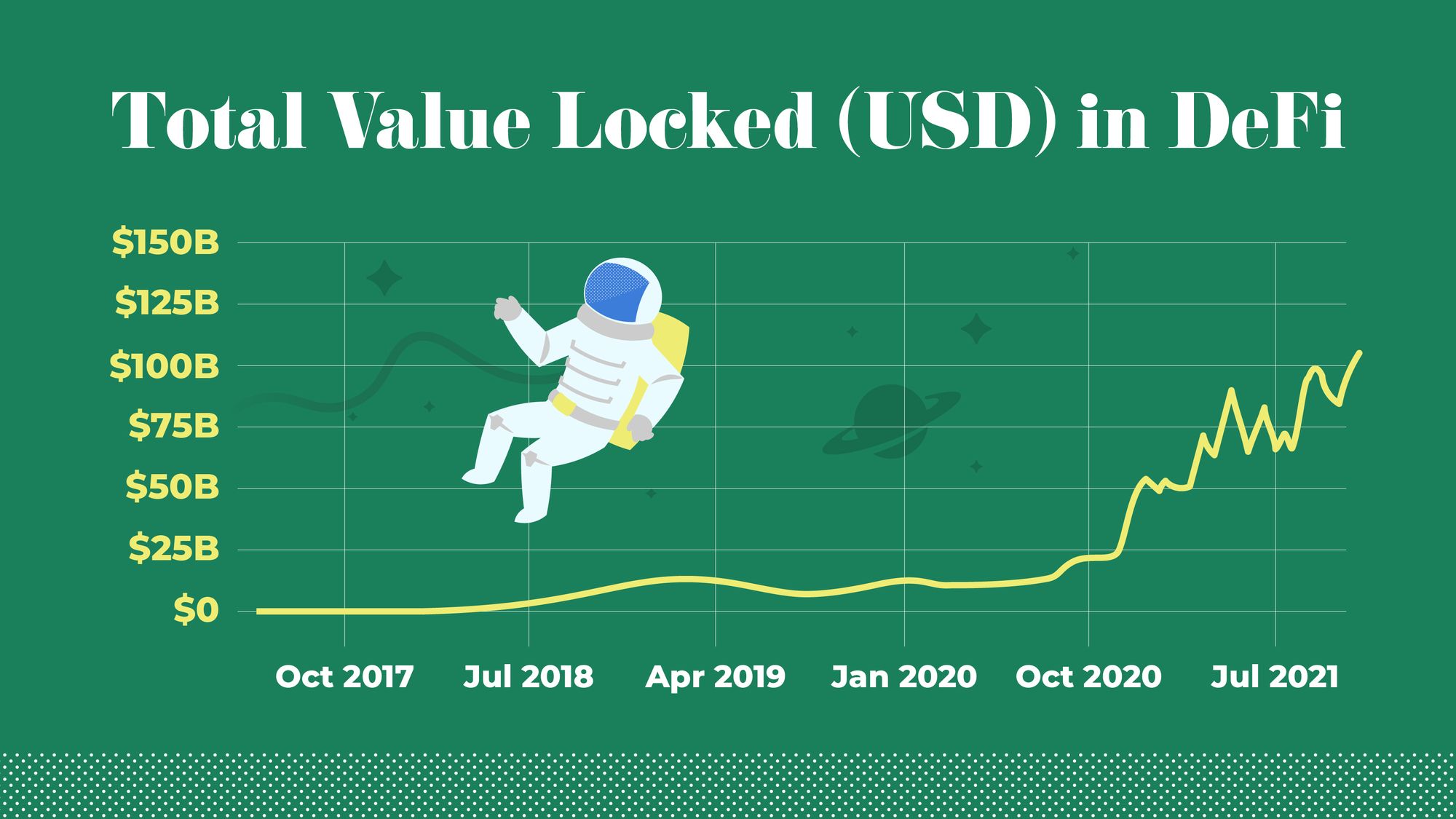

The Decentralized Finance or DeFi movement is meant to change this through applications (DApps), programs, and contracts that use public blockchain networks and offer services like crypto exchanges, payments, and lending. Currently, there is over $100 billion worth of assets in the global DeFi marketplace, up from less than $4 billion this time in 2018. And now that there are a wide variety of traditional and non-traditional companies — everyone from Coinbase to Mastercard to US Bank — involved in cryptocurrency payments and trading, there seem to be a number of cracks appearing in the traditional banking walls.

Busting sustainable investing myths

The utterance of the phrase "Greed, for lack of a better word, is good” in 1987’s Wall Street, summed up the dominant ideology of the era But since then we’ve experienced economic crises, climate change disasters, powerful social justice movements, and a global pandemic.

Now, the biggest trend on Wall Street is sustainable investing, which asks more of businesses than just maximizing short-term profit. Last year $17 trillion was managed this way in the U.S, representing nearly one-third of all investments. For those who remember Hollywood’s portrayal of the investing world, it’s hard to take investing with a conscience seriously at first. “Really, these giant corporations care what I think? I can stick firmly to my morals and still make money?”

The answer is yes!

Myth #1: It will negatively impact my returns. If you avoid certain industries or companies, you can still find solid returns elsewhere. But it’s important to know screening is just one form of sustainable investing. For example, you can instead use ESG strategies, which most studies have linked to improved financial performance, even during the pandemic.

Myth #2: There are too few investment opportunities and I can’t diversify. While it’s true that stocks are currently a popular option to invest ethically, that’s expanding rapidly. There are a wide variety of ESG and sustainably-focused ETFs and Mutual Funds to choose from, as well as a growing cadre of green bonds and funds that explicitly state they are “impact investing funds.”

Myth #3: It’s a lot of work and there’s no impact. How and where you invest (and don’t invest) your money can make a real impact. FWIW is here to try to help give you the confidence you need to make the process as straightforward as possible. As we said above, you can start simple, like studying the options in your 401(k). Always make sure you’re learning from trusted and reliable sources (and not username dogecoin-lover420). There are a number of good resources available, such as As You Sow’s tools, to analyze your funds for exposure to fossil fuels, gender equality, tobacco, etc.

Finally, don’t forget that, as a stockholder, you can have an impact on the companies in which you invest. Activist campaigns, often anchored by shareholder resolutions, can catalyze change on critical environmental and social issues. For some insights into how shareholders had an impact in the last year and ideas for how you can take action, check out this guide to the 2021 proxy season.

Myth #4: It’s a bubble and there’s rampant greenwashing. While there is progress on defining standards, we do need more rules on data and transparency so that investors don’t get misled. Speculation in any area, including clean energy, is risky. But sustainable investing as an approach is not a fad that will be discarded— it’s the direction investing is headed in.

Myth #5: Improving impact costs a company money. Yes, transitioning to a more sustainable model does incur upfront costs, but companies are increasingly finding that going green is good for their bottom line. Many CEOs have made it clear that they expect these initial outlays will pay off in the long run and that they’ve seen costs, like reduction in liability insurance, tied to improvements in ESG scores. And some companies are seeing expansive growth, with HP’s CEO recently crediting the company’s sustainability efforts with attracting more than $1 billion in sales in 2020.

Before you go -

Climate change joined COP26 as an uninvited guest when extreme weather temporarily suspended rail travel from London to Glasgow before the summit’s kickoff.